Introduction

India has numerous banks operating on its soil, with IDFC being one of the top players. In fact, IDFC FIRST Bank has a really important role in the Indian banking industry and has helped with the economy. It has moreover captivated the hearts of many customers through its customer-centric services. Besides, IDFC is trying its best to move along with digital developments, setting itself apart from its competitors. It still has a traditional approach to things, yet we can’t neglect its efforts for transformation and constant adaptation to modern technologies. Within all of these, there’s an important panel of IDFC, which is their iConnect system. It involves a prominent online portal for customers to access a wide range of banking services wherever and whenever. Through the same, customers can expect innovative solutions, top-notch customer service, cutting-edge solutions and more. This article covers all the important points iConnect IDFC, that you ought to know as a prominent customer.

About iConnect IDFC

You can consider iConnect as an intermediary between customers and the bank. It is a simple digital gateway, meant to help users find relevant banking services that are specifically designed by IDFC FIRST Bank as no other banks are involved. Here, all possible banking needs are fulfilled and managed without having to visit a physical branch. It screams convenience, making customers get closer to the bank even though you don’t get nearer. The distinction here lies in your smartphone and the web portal of iConnect which involves secured banking services tailored for customers.

What Makes iConnect IDFC Special?

The core of iConnect IDFC is digital transformation. It was developed for the convenience of customers, with a promise to simplify the existing banking norms. With the creation of such an innovative platform, customers are no longer mandated to visit a physical bank branch. They can save more time and effort just by registering on iConnect, which features multiple online banking tools. Some of what you can find here, include sections for checking balances, transferring funds, accessing passbook details or transaction history, etc.

At FIRST, customers might fear using this panel due to its vulnerable nature. But understanding the need for security, IDFC FIRST Bank has implemented a secure system, allowing one to get a personalized experience without worrying about anything. Whether you are here for personal banking, net banking, or to do tasks — everything is protected and leaves no room for threatening factors.

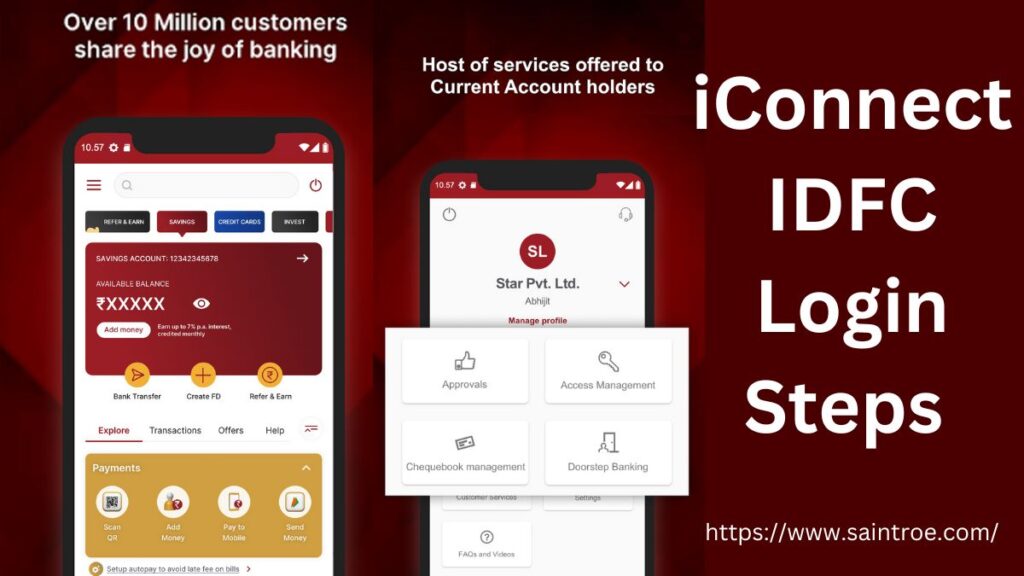

iConnect IDFC Login Steps

- Start by visiting your device’s search engine and using its search tool, type ‘iConnect IDFC’.

- A list of related websites should be pinned down on the landing page.

- Avoid all and just focus on the right address, which should be listed as the FIRST thing.

- Locate the same and click to open the relevant page.

- It will then ask for your login ID and password; provide the details and submit.

- You should now have your dashboard in view.

- If not, check the credentials and re-attempt once more.

- In case, the entered password is the issue, try changing it using the forgot password section, available on the same login window.

Advantages of iConnect IDFC

As a user of iConnect IDFC, you’ll get access to a series of perks, such as:

- Friendly Interface: To make sure that more people are using the remote services, IDFC has leveraged advanced tools, while keeping user-centricity in mind. The end product, i.e., the iConnect portal comes with an interface holding an intuitive design, just perfect for beginners.

- Secured feeling: IDFC is a reliable and reputed bank in India. To maintain a good image throughout and for the sake of ethics, it was obvious for them to include security protocols.

- Convenience: iConnect screams convenience and is the hub for multiple remote banking services that one can access with a free screen tap. Also, unlike physical branches, the portal is operational 24*7 and takes no break in between.

What is the IDFC FIRST Reporting System About?

Like iConnect, the FIRST Reporting System is another important panel of IDFC, allowing one to go through different banking metrics and data in detail. It benefits every individual associated with the bank but is particularly useful for analysts, stakeholders and individuals of similar backgrounds. The features are supportable on its unique login portal and you’d have to register separately to enjoy the benefits.

Working at IDFC FIRST Bank

IDFC FIRST Bank values creativity, talent and innovation and many suggest the place to be ideal for working. In most branches, you’ll see a dynamic team that works to offer exceptional banking services to IDFC customers. Plus, the environment it nurtures is great for employees and even the payscale is worthwhile. You’ll moreover be glad to know that IDFC FIRST Bank enlists multiple career opportunities regularly. To know more, you can visit their official website and navigate straight to the careers section.

Conclusion

IDFC FIRST Bank has received a reputable status for doing nothing. Instead, the bank has tirelessly worked to receive its name and constantly looks to make things better. Its dedication is worthy of appreciation, which is also why customers are certain to receive a seamless online experience. That is, being a customer of IDFC, you will be guided throughout and managing finances is possible within a few clicks only. From checking account balances to transferring funds, and availing exclusive features from iConnect IDFC — things look extremely good for now.

FAQs About iconnect idfc

Ans IDFC stands for ‘Infrastructure Development Finance Company’ and is one of the most prominent banks in all of India. IDFC is presently known for providing efficient financial solutions via its branches and Internet banking portals. Its headquarters is located in Mumbai and has branches scattered globally.

Ans IDFC FIRST Bank belongs to the private sector. It was in 2014 when the bank received an in-principle approval from RBI. Post-approval, the owners got the right to begin establishing itself as a new bank in the private sector.

Ans IDFC stepped into the market in 1997 but only as an infra lender. It went on with the initial status, until RBI sent the approval in April 2014, permitting it to set up a new bank. By October 2015, IDFC Bank was officially launched with the beginning of on-tap licensing. Gradually, the bank began operating with open wings and provided services like loans.

Ans IDFC FIRST Bank claims to offer zero-fee banking on Rs 10,000 Average Monthly Balance for Savings Accounts including higher account variants. From what it seems, these offerings come from good faith, although failing to maintain the rules might get one charged with fees.

Ans iConnect IDFC is an important portal for both the bank and its users for it acts as an intermediary between the two. In this portal, you’ll come across different services enlisted by the bank. Meanwhile, customers can use the provided services to fulfil their banking needs and have things done remotely.

Also read about: